2. Other shares and interests (Funds operated by pension management companies, total) - ekonomika ČNB

Nové časové řady makroekonomiky a jejich data

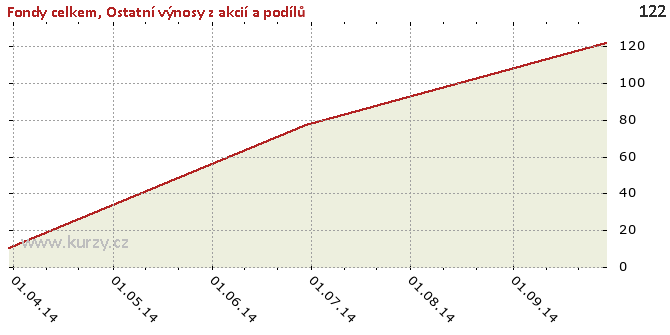

Graf hodnot, Funds operated by pension management companies, total

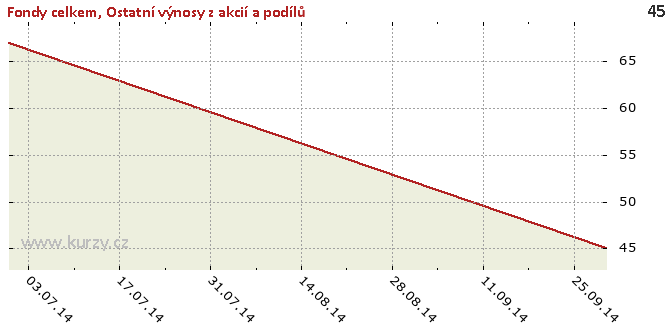

Přepočtený graf hodnot

Časová řada 2. Other shares and interests obsahuje kumulované roční údaje. Následující graf hodnot zobrazuje přepočtená rozdílová data.

Meziroční srovnání

Minima a maxima

| Typ | Období | Hodnota |

|---|---|---|

| Max | 30.09.2014 | 122.00 |

| Min | 31.03.2014 | 10.00 |

Historické hodnoty

| Období | Hodnota | Předchozí | Rozdíl | Změna | Před rokem | Rozdíl | Změna |

|---|---|---|---|---|---|---|---|

| 30.09.2014 | 122.00 | 77.00 | 45.00 | 58.44% | - | - | - |

| 30.06.2014 | 77.00 | 10.00 | 67.00 | 670.00% | - | - | - |

| 31.03.2014 | 10.00 | - | - | - | - | - | - |

Graf jako obrázek

Podobné sestavy

Aplikace Ekonomika ČNB ze sekce makroekonomika zobrazuje časové řady hlavních makroekonomických údajů z ekonomiky ČR. Najdete zde přes 10.000 grafů různých hodnot od úrokových sazeb, přes statistiky státního rozpočtu, statistiky ČNB a data zpracovávaná ČSÚ. Data jsou k dispozici obvykle za posledních více než 20 let, od prosince roku 1992. Zdroj dat: ČNB ARAD