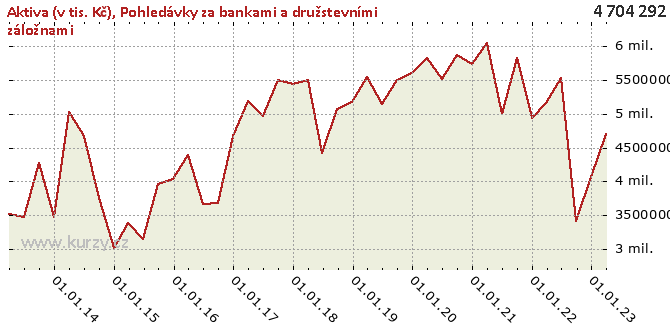

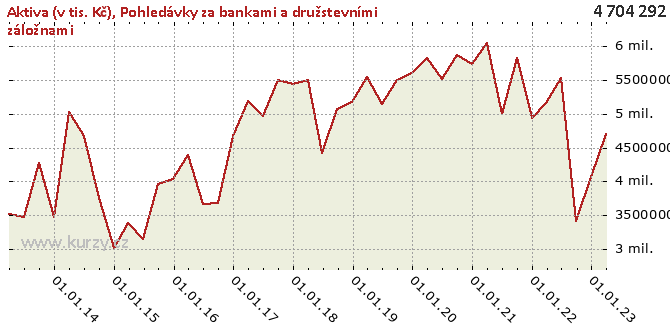

Receivables from banks and credit unions - ekonomika ČNB

Aktualizace dat

Receivables from banks and credit unions v této aplikaci skončila 30.6.2023. Aktualizovná data časových řad najdete na stránkách nové aplikace z dat

ARAD ČNB

Graf hodnot, Assets (in CZK thousands)

Nahrávám interaktivní graf ...

Nahrávám interaktivní graf ...

Meziroční srovnání

Receivables from banks and credit unions - Nahrávám graf - roční srovnání ...

Receivables from banks and credit unions - Nahrávám graf - roční srovnání ...

Minima a maxima

Historické hodnoty

| Období |

Hodnota |

Předchozí |

Rozdíl |

Změna |

Před rokem |

Rozdíl |

Změna |

| 31.03.2020 |

5 826 317.00 |

5 601 122.00 |

225 195.00 |

4.02% |

5 546 120.00 |

280 197.00 |

5.05% |

| 31.12.2019 |

5 601 122.00 |

5 503 989.00 |

97 133.00 |

1.76% |

5 175 002.00 |

426 120.00 |

8.23% |

| 30.09.2019 |

5 503 989.00 |

5 151 429.00 |

352 560.00 |

6.84% |

5 073 156.00 |

430 833.00 |

8.49% |

| 30.06.2019 |

5 151 429.00 |

5 546 120.00 |

- 394 691.00 |

-7.12% |

4 424 924.00 |

726 505.00 |

16.42% |

| 31.03.2019 |

5 546 120.00 |

5 175 002.00 |

371 118.00 |

7.17% |

5 492 221.00 |

53 899.00 |

0.98% |

| 31.12.2018 |

5 175 002.00 |

5 073 156.00 |

101 846.00 |

2.01% |

5 435 520.00 |

- 260 518.00 |

-4.79% |

| 30.09.2018 |

5 073 156.00 |

4 424 924.00 |

648 232.00 |

14.65% |

5 493 601.00 |

- 420 445.00 |

-7.65% |

| 30.06.2018 |

4 424 924.00 |

5 492 221.00 |

-1 067 297.00 |

-19.43% |

4 968 502.00 |

- 543 578.00 |

-10.94% |

| 31.03.2018 |

5 492 221.00 |

5 435 520.00 |

56 701.00 |

1.04% |

5 184 358.00 |

307 863.00 |

5.94% |

| 31.12.2017 |

5 435 520.00 |

5 493 601.00 |

-58 081.00 |

-1.06% |

4 671 257.00 |

764 263.00 |

16.36% |

| 30.09.2017 |

5 493 601.00 |

4 968 502.00 |

525 099.00 |

10.57% |

3 679 606.00 |

1 813 995.00 |

49.30% |

| 30.06.2017 |

4 968 502.00 |

5 184 358.00 |

- 215 856.00 |

-4.16% |

3 664 286.00 |

1 304 216.00 |

35.59% |

| 31.03.2017 |

5 184 358.00 |

4 671 257.00 |

513 101.00 |

10.98% |

4 396 046.00 |

788 312.00 |

17.93% |

| 31.12.2016 |

4 671 257.00 |

3 679 606.00 |

991 651.00 |

26.95% |

4 029 932.00 |

641 325.00 |

15.91% |

| 30.09.2016 |

3 679 606.00 |

3 664 286.00 |

15 320.00 |

0.42% |

3 956 548.00 |

- 276 942.00 |

-7.00% |

| 30.06.2016 |

3 664 286.00 |

4 396 046.00 |

- 731 760.00 |

-16.65% |

3 148 801.00 |

515 485.00 |

16.37% |

| 31.03.2016 |

4 396 046.00 |

4 029 932.00 |

366 114.00 |

9.08% |

3 386 166.00 |

1 009 880.00 |

29.82% |

| 31.12.2015 |

4 029 932.00 |

3 956 548.00 |

73 384.00 |

1.85% |

3 010 998.00 |

1 018 934.00 |

33.84% |

| 30.09.2015 |

3 956 548.00 |

3 148 801.00 |

807 747.00 |

25.65% |

3 751 294.00 |

205 254.00 |

5.47% |

| 30.06.2015 |

3 148 801.00 |

3 386 166.00 |

- 237 365.00 |

-7.01% |

4 676 558.00 |

-1 527 757.00 |

-32.67% |

| 31.03.2015 |

3 386 166.00 |

3 010 998.00 |

375 168.00 |

12.46% |

5 025 070.00 |

-1 638 904.00 |

-32.61% |

| 31.12.2014 |

3 010 998.00 |

3 751 294.00 |

- 740 296.00 |

-19.73% |

3 480 874.00 |

- 469 876.00 |

-13.50% |

| 30.09.2014 |

3 751 294.00 |

4 676 558.00 |

- 925 264.00 |

-19.79% |

4 276 933.00 |

- 525 639.00 |

-12.29% |

| 30.06.2014 |

4 676 558.00 |

5 025 070.00 |

- 348 512.00 |

-6.94% |

3 471 674.00 |

1 204 884.00 |

34.71% |

| 31.03.2014 |

5 025 070.00 |

3 480 874.00 |

1 544 196.00 |

44.36% |

3 523 924.00 |

1 501 146.00 |

42.60% |

| 31.12.2013 |

3 480 874.00 |

4 276 933.00 |

- 796 059.00 |

-18.61% |

- |

- |

- |

| 30.09.2013 |

4 276 933.00 |

3 471 674.00 |

805 259.00 |

23.20% |

- |

- |

- |

| 30.06.2013 |

3 471 674.00 |

3 523 924.00 |

-52 250.00 |

-1.48% |

- |

- |

- |

| 31.03.2013 |

3 523 924.00 |

- |

- |

- |

- |

- |

- |

Graf jako obrázek

Ekonomické ukazatele České národní banky

Podobné sestavy

Aplikace Ekonomika ČNB ze sekce makroekonomika

zobrazuje časové řady hlavních makroekonomických údajů z ekonomiky ČR.

Najdete zde přes 10.000 grafů různých hodnot od úrokových sazeb, přes statistiky státního rozpočtu, statistiky ČNB a data zpracovávaná ČSÚ.

Data jsou k dispozici obvykle za posledních více než 20 let, od prosince roku 1992.

Zdroj dat: ČNB ARAD

Zobrazit sloupec