Commodities and derivates - Home page

Contents Section Commodities and derivatives: For derivatives designated trades, whose value is derived (derives) from the rate of a particular asset, such as commodities, stocks, stock index, currency, etc. There are many types of derivatives, the most common are futures contracts, options and forwards (see further explanation below). In this section you can find values futures contracts on commodities (different types of food and raw materials), zemědělské komodity (pšenice, káva, bavlna), finances (dluhopisy, úrokové sazby, měny, indexy) and news relating to commodities.

Deriváty na komodity - ropa, zlato

| $[$p5#g10`kom_tit_ropa] | $[$p5#g11`kom_tit_zlato] |

Zpravodajství z komodit

Futures contract can be simply characterized as an agreement the two parties to buy / sell a standardized quantity of commodities at pre-specified quality at that price at that future date. Futures contracts can be traded only in organized markets-stock exchanges. This is the so-called hard business, which at that time one party has an obligation to buy and the other party has the obligation to sell. In the futures contract settlement between the two parties enter a contract clearing center, which guarantees the settlement. This is the main advantage of futures contracts.

Option is a contract that gives the option buyer the right but not the obligation, to buy or sell a commodity, asset or futures contract at a predetermined price within a stipulated time. Option is called the conditional trade, because the option buyer may or may not in the future to buy or sell. If the purchaser exercises its right, the seller (the organizers) option must always meet its obligations.

Forward is essentially identical to the futures contract. The difference is that forward with some exceptions traded outside the stock market. This leads to another difference: the futures contract is standardized in terms of the contract volume, commodity type, maturity and market price is determined only while the individual forward and conditions depend on the agreement the two parties.

USd U.S. cent.

Rate futures on commodities according to the type of 25.7.2024

| Energy | |||||||||

| Name | Unit | Curr | Market | Date | Max | Min | Close | Change | |

|---|---|---|---|---|---|---|---|---|---|

| Brent Crude Oil | USD/bbl. | USD | IPE | JUL 25 | 81.90 | +0.37 | |||

| Electricity | EUR/MWh | EUR | PXE | 20240725 | 92.10 | ||||

| Gas Oil | USD/MT | USD | IPE | JUL 25 | 755.63 | +4.50 | |||

| Gasoline RBOB | USd/gal. | USd | NYM | JUL 25 | 2.43 | +0.02 | |||

| Heating Oil | USd/gal. | USd | NYM | JUL 25 | 2.47 | +0.02 | |||

| Henry Hub Natural Gas | USD/MMBtu | USD | IPE | JUL 25 | 2.08 | -0.06 | |||

| PXE - Natural Gas | EUR/MWh | EUR | PXE | 20240725 | 39.09 | ||||

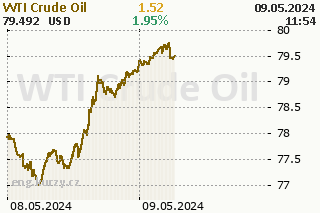

| WTI Crude Oil | USD/bbl. | USD | IPE | JUL 25 | 78.11 | +0.59 | |||

| Food | |||||||||

| Name | Unit | Curr | Market | Date | Max | Min | Close | Change | |

|---|---|---|---|---|---|---|---|---|---|

| Cocoa | USD/MT | USD | ICE | JUL 25 | 7859.00 | -358.00 | |||

| Coffee C - Arabica | USd/lb. | USd | ICE | JUL 25 | 232.60 | +1.97 | |||

| Sugar No.11 | USd/lb. | USd | ICE | JUL 25 | 18.68 | +0.72 | |||

| Grain/Oilseed | |||||||||

| Name | Unit | Curr | Market | Date | Max | Min | Close | Change | |

|---|---|---|---|---|---|---|---|---|---|

| Corn | USd/bu. | USd | CBT | JUL 25 | 406.25 | +2.38 | |||

| Soybeans | USd/bu. | USd | CBT | JUL 25 | 1078.94 | +15.94 | |||

| Wheat | USd/bu. | USd | CME | JUL 25 | 537.31 | -10.19 | |||

| Industrial | |||||||||

| Name | Unit | Curr | Market | Date | Max | Min | Close | Change | |

|---|---|---|---|---|---|---|---|---|---|

| Cotton No.2 | USd/lb. | USd | ICE | JUL 25 | 68.90 | +0.17 | |||

| Livestock | |||||||||

| Name | Unit | Curr | Market | Date | Max | Min | Close | Change | |

|---|---|---|---|---|---|---|---|---|---|

| Metal | |||||||||

| Name | Unit | Curr | Market | Date | Max | Min | Close | Change | |

|---|---|---|---|---|---|---|---|---|---|

| Copper | USd/lb. | USd | NYM | JUL 25 | 4.11 | +0.03 | |||

| Gold | USD/t oz. | USD | LME | JUL 25 | 2360.32 | -39.65 | |||

| Palladium | USD/t oz. | USD | NYM | JUL 25 | 894.50 | -24.00 | |||

| Platinum | USD/t oz. | USD | NYM | JUL 25 | 942.80 | -15.13 | |||

| Silver | USD/t oz. | USD | LME | JUL 25 | 27.78 | -1.15 | |||

Používané jednotky:

- USd = 1 cent

- 1,000 board ft. = 2,360 m3

- barel = 158,987 litrů

- bušl = 35,239 litrů

- cwt (hundredweight = 100 lb) = 45,359 kg

- galon = 3,785 litrů

- libra = 0,454 kg

- MMBtu (1 milion BTU = British termal unit) = 1,054615 GJ

- trojská unce = 0,0311 kg

Trhy s komoditami:

- CBT - Chicago Board of Trade

- CMC - CryptoCurrency Market Capitalizations

- CME - Chicago Mercantile Exchange

- Eurex - EUREX

- EUX - EUREX Deutschland

- ICE - ICE Futures

- IPE - International Petroleum Exchange (ICE Futures)

- KCBOT - Kansas City Board of Trade

- LME - London Metal Exchange

- MGEX - Minneapolis Grain Exchange

- MXE - Montreal Exchange

- NYM - New York Mercantile Exchange

- NYSEE - NYSE Euronext

- PXE - Power Exchange Central Europe

{nazory}